Food startup Pilot Failure have always been challenging when developing a food and beverage company. With the advent of shared kitchens, contract manufacturers and small batch processing equipment, entrepreneurs are able to now launch pilot product testing at an incredible speed than ever before. Entrepreneurial testing results are encouraging (early success can often provide a false sense of accomplishment; however, it is important). An alarming trend; it has been estimated that nearly 70% of food & beverage companies fail to get beyond the pilot stage. The transition from pilot batch methodology to full production is perhaps the most important step and possibly the most difficult part of the overall development of any food based company.

The transition from pilot batching to full production exposes the shortcomings of the creativity of the entrepreneurial idea to the challenges posed by high production costs, increased operational complexity, regulatory requirements and external competition. Successful performance in a mandatorily controlled testing environment is far from an indicator of success in a full volume production environment when product uniformity becomes a key factor. Understanding food startup pilot failure is critical for any entrepreneur looking to create a successful brand. This transition to full production signifies that an entrepreneur has created a viable business opportunity and that he/she must create a strategic plan, develop scalable systems and make sound, financially responsible decisions in moving from pilot to full production.

Want to optimise your Food Business? Request a free consultation!

Explore Our Exclusive Food Product Development

In this blog post, we will explore why so many food and beverage startups interrogate failures after the pilot stage, as well as the major gaps that impede product movement toward commercialisation.

Understanding the Pilot Scale Illusion

Achieving pilot level success can be difficult for many entrepreneurs. Small batches are often not a requirement of the entrepreneur at this point in their journey since all components are tested under pre existing conditions without having to worry about manual or automatic adjustments. The result is that early adopters typically provide the entrepreneur with “thumbs-up” comments about the product and increased levels of confidence regarding the product.

However, a food startup pilot failure does not test real world conditions such as continuous production, shelf-life stability, supply chain stress, or cost efficiency. Many startups confuse product validation with business validation, leading to overconfidence during expansion.

This disconnect is one of the early causes of food startup pilot failure.

Lack of Scale-Ready Formulation

A common reason for food & Beverage startups failing after a pilot failure is that the formulation itself is not designed for scale.

Ingredients that perform well in small batches may:

- Separate or degrade in large volumes

- React differently under industrial heat or pressure

- Lose flavour, texture, or visual appeal

- Become unstable during storage or transportation

Startups often scale production before conducting proper scale-up trials, assuming the recipe will behave the same, which it rarely does. Without formulation optimisation for industrial conditions, quality inconsistencies emerge, damaging brand trust early in the market.

You May Also Like: Art and Science of Food Formulation

Underestimating Cost Escalation

At the pilot scale, cost structures look manageable. At a commercial scale, they change drastically.

- Ingredient MOQ (minimum order quantities)

- Packaging upgrades required for retail

- Increased labour and wastage

- Energy, logistics, and cold chain expenses

Most startups use what is acknowledged as pilot pricing methodology when establishing a product’s price, rather than pricing the product based on the actual cost of manufacturing. As the difference between the cost and the price shrinks, many companies increase their prices, decrease their quality, or experience excessive loss, all three of which are among the more frequent reasons that food startups fail in their pilot stage.

Suggested Read: Cost of Food Formulation / Product Development

Weak Supply Chain Planning

Pilot operations rely on flexible sourcing. Commercial operations demand consistency.

Food & Beverage startups often fail to secure:

- Reliable ingredient suppliers with volume consistency

- Backup vendors for risk mitigation

- Predictable lead times

- Quality controlled raw material inputs

Any disruption to crop variability, import delays, or price volatility can halt production or affect quality. Without a structured supply chain strategy, scaling becomes fragile and unpredictable.

Regulatory and Compliance Gaps

Regulatory compliance is manageable at a pilot scale but becomes complex at commercial levels.

Startups frequently underestimate requirements related to:

- Food safety certifications

- Label accuracy and claims substantiation

- Shelf-life validation

- Allergen control and traceability

Non-compliance can delay launches, trigger product recalls, or result in penalties. For many young brands, regulatory setbacks consume time and capital that they cannot recover from accelerating failure after pilot scale.

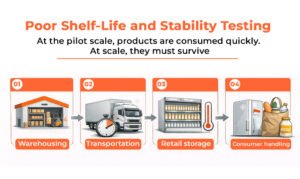

Poor Shelf-Life and Stability Testing

Shelf life is not just a technical metric; it is a commercial necessity.

At the pilot scale, products are consumed quickly. At scale, they must survive:

- Warehousing

- Transportation

- Retail storage

- Consumer handling

Many startups skip extended stability studies to save time. As a result, products fail in market due to spoilage, texture breakdown, flavour loss, or packaging failures. These issues are expensive to fix once distribution has started and are a major reason why food startup pilot failure occurs silently but rapidly.

Manufacturing Partner Mismatch

Choosing the wrong manufacturing partner is a critical scaling mistake.

Pilot success often happens in:

- R&D kitchens

- Small co-packing facilities

- Semi manual setups

When moving to scale, startups may partner with manufacturers who:

- Lack category expertise

- Cannot maintain product consistency

- Do not support flexible batch sizes

- Prioritise large clients over startups

Operational misalignment leads to delays, rework, and rising costs eroding momentum at a critical growth stage.

Over-Reliance on Early Consumer Feedback

Early customers are not the mass market.

Pilot stage feedback usually comes from:

- Friends and family

- Niche consumers

- Health focused or trend aware buyers

Scaling exposes the product to mainstream consumers with different expectations around price, taste, convenience, and branding. Startups that over index on early validation often fail to adapt, resulting in weak repeat purchases and declining traction post launch.

Insufficient Working Capital

Scaling a food business is capital intensive. Many founders underestimate how long profitability will take.

Key cash drains include:

- Inventory holding

- Distributor margins

- Marketing and trade promotions

- Delayed retailer payments

Running out of working capital, rather than a lack of demand, is one of the most common reasons Food & Beverage startups fail after reaching pilot scale. Without financial buffers, even a good product can collapse under the pressure of cash flow.

Absence of a Clear Go-To-Market Strategy

A strong product does not guarantee sales.

Startups often focus heavily on product development but neglect:

- Channel specific pricing

- Distribution economics

- Marketing scalability

- Consumer education

Pilot sales are usually direct or limited. Commercial success requires structured go-to-market execution. Without it, products struggle to gain visibility, velocity, and shelf rotation, leading to stagnation and eventual exit.

Conclusion

The failure of a food and beverage startup after the Pilot stage is commonly not due to a poor or weak idea, but rather because the startup underestimated; which is truly needed to scale a product or service. In working through the transition from Pilot Batches to commercial production, food startups will uncover many areas that are not properly in place; formulation gaps, cost planning, supply chain, compliance, alignment with the manufacturing process, and financial readiness. The activities that work well in a controlled, small-scale environment typically do not immediately carry over to larger-scale, continuous, and profitable operations. Food and beverage startup businesses that has successfully transformed from a food startup pilot failure to Commercial production, think of scaling as a strategic transformation to have a mass gain in volume.

Need Help Developing Your Food Product?

Foodsure helps startups and FMCG brands turn food ideas into successful, market-ready products. From formulation to manufacturing, we simplify the entire journey so you can launch faster, safer, and more profitably.

Why 500+ Brands Choose Foodsure

- R&D and product formulation support

- Cost optimization without quality compromise

- Private label and co-manufacturing solutions

- Regulatory and compliance guidance (FSSAI, labeling)

- Pilot trials, shelf-life testing, and stability studies

- Packaging, scaling, and go-to-market support

Who We Work With

- D2C founders launching their first product

- FMCG companies expanding product lines

- Restaurants & cloud kitchens creating packaged foods

- Health, fitness, and Ayurveda focused brands

- Export brands needing compliant formulations

Book a Free Consultation

Tap into expert guidance for your food product. Whether it’s R&D, formulation, scaling, or manufacturing, our team will help you build the perfect solution.

Frequently Asked Questions

Why do most food startups fail after the pilot stage?

Most failures occur due to poor scale readiness, cost miscalculations, supply chain gaps, regulatory issues, and lack of working capital.

Does pilot success guarantee commercial success?

No. Pilot success validates the product idea but does not confirm operational, financial, or market scalability.

What is the biggest mistake startups make during scale-up?

Assuming the pilot formulation, costs, and processes will behave the same at the commercial scale.

How important is formulation optimisation before scaling?

Extremely important. Scale-ready formulations ensure consistency, shelf life, and product stability in large volumes.

When should regulatory compliance be addressed?

Regulatory planning should begin during pilot development, not after scaling begins.

Why is shelf-life testing critical before launch?

Shelf-life failures lead to recalls, brand damage, and financial losses once products enter wider distribution.

Can the wrong manufacturing partner cause failure?

Yes. Manufacturing misalignment often leads to inconsistency, delays, cost overruns, and quality issues.

Is early consumer feedback reliable for scaling decisions?

Early feedback is useful but limited and may not reflect mass-market behaviour or price sensitivity.

How much working capital is needed after pilot scale?

More than most founders expect. Inventory, distribution margins, and delayed payments create heavy cash-flow pressure.

How can startups reduce the risk of pilot failure?

By planning for scale early, validating costs and supply chains, conducting stability studies, and building a clear go-to-market strategy.