High protein bars and high protein snacks are no longer exclusive to professional athletes. They are increasingly being found on the shelf at supermarkets, through fast delivery apps, and even at corporate cafeterias. However, not all high protein snacks reach commercial success. Many times, this happens when the product fails not because consumers do not want protein, but because innovation takes place in a vacuum, where numbers surrounding nutritional need drive the process, irrespective of the consumption experience, regulatory facts, cost calculations, and the habit of repeat business.

This blog draws your attention into the strategies among the best companies employ to come up with high protein snacks that really convert once, and then you keep selling.

Want to optimise your Food Business? Request a free consultation!

Food Product Development Services – Click Here

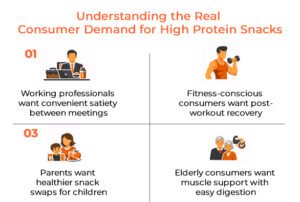

Understanding the Real Consumer Demand for High Protein Snacks

Before formulation begins, smart brands invest time in understanding why consumers are buying protein snacks in the first place.

The motivations vary widely:

- Working professionals want convenient satiety between meetings

- Fitness-conscious consumers want post-workout recovery

- Parents want healthier snack swaps for children

- Elderly consumers want muscle support with easy digestion

A formulation designed only for “high protein snacks” without defining the end user often results in products that are nutritionally perfect but commercially weak.

This is why successful high protein snacks development starts with consumer segmentation, not ingredient selection.

You May Also Like: How Startups Can Successfully Develop High-Protein Snacks That Sell

Defining the Right Protein Target Per Serving

One of the biggest formulation mistakes brands make is chasing the highest protein number possible. While 20 g protein per serving may look impressive on-pack, it can negatively remind taste, texture, and digestibility if not engineered properly.

Winning brands align protein levels with snacking occasions:

- 8–10 g protein: everyday snacking, mass-market appeal

- 12–15 g protein: functional nutrition, office and fitness users

- 18–20 g protein: sports nutrition and performance-focused SKUs

More protein is not always better. The right protein target ensures the product remains enjoyable, affordable, and easy to consume regularly.

Taste Optimisation Beyond Sweetness

Taste is not limited to sweetness levels. high protein formulations require balancing bitterness, metallic notes, and lingering aftertastes that proteins often introduce.

Successful brands approach flavour development holistically:

- Selecting flavour systems that mask protein notes naturally

- Using acidulants, cocoa, spices, or roasted notes strategically

- Avoiding excessive sweeteners that create flavour fatigue

Products that “taste fine” on the first bite but become unpleasant by the last rarely survive long-term in the market. Taste repeatability matters more than initial novelty.

Clean Label and Claim Strategy

Modern consumers read labels closely. Claims such as high protein snacks, clean label, no added sugar, reminder gluten-free, or vegan influence purchase decisions but only when they are credible.

Brands that formulate for success ensure that:

- Claims are supported by ingredient composition

- Additives are minimised without compromising shelf life

- Label language remains compliant with regulatory frameworks

Overclaiming may attract attention initially but often leads to reformulation costs, regulatory challenges, or consumer distrust later.

Shelf Life and Stability as Commercial Priorities

A high protein snack that tastes great at launch but degrades within weeks is a commercial risk. Protein-rich formulations are particularly sensitive to moisture migration, oxidation, and texture hardening over time.

Winning brands conduct structured shelf-life testing to evaluate:

- Texture retention

- Flavour stability

- Microbial safety

- Packaging compatibility

Shelf stability is not just a technical requirement it directly impacts distribution reach, export readiness, and inventory planning.

Packaging Decisions That Support Protein Integrity

Packaging is often treated as a marketing afterthought, but for high protein snacks, it is part of the formulation strategy.

Proper packaging protects against:

- Moisture ingress

- Oxygen exposure

- Texture degradation

Brands that scale successfully select packaging formats that align with both product sensitivity and consumer convenience, ensuring the snack performs consistently from factory to consumption.

Learn More: Food Packaging and Labelling

Cost Engineering Without Compromising Quality

high protein ingredients are expensive. Brands that survive long-term design formulations with cost-per-serving visibility from day one.

This includes:

- Optimising protein dosage without excess

- Selecting ingredient suppliers strategically

- Designing scalable processes that reduce wastage

Affordability is a key driver of repeat purchases, especially in price-sensitive markets.

Read More: Cost of Food Formula

Why Successful Brands Invest in Pilot Testing

Before full-scale launch, experienced brands invest in pilot-scale production. This stage helps identify challenges that do not appear in lab formulations, such as processing behaviour, texture shifts, or packaging interactions.

Pilot testing bridges the gap between concept and commerce. It ensures that what works on paper also works on production lines and in real-world distribution.

Conclusion

The popularity of protein-rich snacks is no coincidence; it is primarily the result of consumer needs, designer-formulated snack food products, aggressive pricing, and more excellent consumer interest.

Successful snack brands work on more than just how many grams of protein that snack has; They work to meet the needs of consumers for the balance of both function and enjoyment while staying within the budgeted price point.

In the modern day Hard Truths era, snack products that are winning are those that offer consumers both the performance benefit of eating snack food with the added enjoyment. It has been communicated through the formulation process of those winning snacks.

Frequently Asked Questions

What makes a high-protein snack successful in the market?

A successful high-protein snack balances protein content, taste, texture, and affordability for repeat consumption.

How much protein should a snack ideally contain?

Most commercially successful snacks contain between 8–15 g of protein per serving.

Which protein sources are best for snack formulation?

Whey, milk proteins, pea protein, and blended protein systems are commonly used based on target consumers and claims.

Why do high-protein snacks often taste chalky?

Chalkiness usually results from poor protein selection, improper particle size, or unbalanced formulation.

Are plant-based protein snacks harder to formulate?

Yes, plant proteins require additional flavour and texture optimisation to achieve consumer acceptance.

How does texture impact repeat purchases?

Unpleasant textures like hardness or dryness significantly reduce the likelihood of repeat buying.

What role does shelf life play in protein snack sales?

Shelf stability ensures consistent quality across distribution and supports wider market reach.

Why is pilot testing important before launch?

Pilot trials reveal processing and stability issues that do not appear at lab scale.

Do clean-label claims affect formulation decisions?

Yes, clean-label positioning directly influences ingredient selection and processing methods.

Why do some high-protein snacks fail after launch?

Most failures occur due to poor taste, texture degradation, or misalignment with consumer expectations.