India’s city workers now prefer functional beverages in the market that provide actual stress relief, improved concentration and extended work capacity during their 12-hour shifts.

But they want beverages that actually provide health benefits, but still taste good and maintain affordable prices.

- Stress Buster Craving: Ashwagandha, deadlines, Cortisol infusions to reduce stress.

- Value Hunt: Multifunction benefits are worth more than the premium price.

- Trust Shift: Any scrutiny of the genuine probiotics on the gimmicks.

The Market Disconnect

The functional beverages market in India is booming, with the market expected to reach $18.8 Billion by 2034 due to the increasing demand for energy, immunity, and gut-boosting beverages by health-conscious consumers.

However, the brands fail in performance, and they develop a gap between the hype and the reality.

Brand Confusion:

- Confusion on Ayurvedic and science-based formulas

- Regulatory hairball with sugar restrictions and effectiveness claims

Consumer Dissatisfaction:

- Health promises, but tastes are flops.

- Distrust of backdoor sugars and unspecified advantages.

Core Gaps:

- Gradual transition to low-sugared, probiotic RTDs

- Accessibility in urban areas is ahead of supply chains

Such a misunderstanding requires clarity on brands and the satisfaction of buyers.

and scale planning decide whether a functional beverage survives beyond launch.

Strategic Missteps Fueling Failure

The functional beverages market in India faces poorly founded strategic mistakes in the face of new trends such as Ayurvedic infusions and sugar-free inventions.

Core Root Causes:

- R&D Bottlenecks: Sluggish probiotic technology lags behind its rivals

- Distribution Skew: Kirana concentrate lacks rapid-business boom

- Pricing Disconnect: Premium tags do not pay attention to value-seekers

- Insider fix: Tune the strategies to urban pulse and make early explosive profits.

Founder Pain Points

- Developing sugar-free, yummy probiotics

- Coding the changing regulations of FSSAI on claims at night

- Obtaining quality ashwagandha in large quantities cheaply

- Trading off high prices and mass market

Everyday Consumer Cravings

Imagine you are an office-goer in Mumbai whose schedule is busy and he/she wants to have a beverage that would provide the soothing effect but not the crashing effect. Simple replacements of cola with ashwagandha tea to combat real-day stress are a revolution in the functional beverages market.

How Indians Think Now:

- Quick Wins: Like to feel energised enough to be at work at 10 AM, but not all day until midnight.

- Checking Wallet: Only pay more when it cures gut problems or enhances concentration per day.

- Taste First: Health claims fail when they are like medicine.

- Trust Gut: Scan labels, natural vibes on fancy ads.

- Social Proof: Viral Instagram sips first, then commits.

It is not so much science, more a matter of, Does this give my mad day the better?

Functional Drinks Snapshot

The functional beverages market of India is ideal to meet the city’s demands, and they combine health and convenience.

| Consumer Need | Drink Type | Why it works in India |

| Stress Relief | Ashwagandha Tea | Ayurvedic roots calm cortisol in high-pressure jobs |

| Gut Health | Probiotic Lassi | Familiar fermented taste with modern microbiome boost |

| Energy Lift | Matcha Green | Sustained focus without soda crash for long commutes |

| Hydration+Focus | Coconut-Ginseng | Natural electrolytes suit tropical climates and desk marathons |

This snapshot reveals targeted innovation opportunities.

What Indian Consumers Really Want in 2026

Indian functional beverages market trends 2026 are directed towards the functionality of urban life.

- Clearly Competitive: Better vitality, bowel, reduced stress during the long working hours and pollution.

- Familiar Components: tulsi, amla, ashwagandha, probiotics. In preparations of lassi, probiotics are natural.

- Taste Preference: Mango-ginger or jeera fizz tasties as compared to medicine via taste.

- Sugar Expectations: Low/low sugar (05g/serving) and crystallisation of stevia or jaggery.

The functional drinks trends will be loyally combined with the tradition and RTD innovations to be loyal.

Strategies That Deliver Results

The success factor in India is a functional beverage market because it has integrated consumer intelligence and strategic performance.

Proven Patterns:

- Taste-Health Fusion: Natural flavours, such as the mango-ashwagandha, disguise functional benefits, are the stimulator of 3x repeat purchase.

- Micro-Claims Strategy: Niche benefits (2-hr concentration enhancement) in the short term.

- Fast-Business Optimisation: both Zomato/Blinkit are 40% of the kirana shelf wars sales velocity.

- Storytelling Ingredients: Tulsi and Himalayan farms are familiar with and culturally affiliated to each other, and they should be offered a premium of 20%.

- Social Proof Loops: The problem of reels is that UGC will automatically become viral.

Common Brand Pitfalls

The majority of functional beverage brands in the market fail due to the strategic errors that can be avoided.

Key Missteps:

- Romance of the New: Exotic super-foods cannot succeed without the familiar flavours of jeera or mango.

- Confusion in terms of Health Rating: “Increases wellness” loses to specific “reduces stress by 30%).

- Sugar Camouflage: Camouflaging among other ingredients shreds label-confident millennials.

- Luxury No Trials: giant prices are not subjected to trials or testimonials backlash.

- Supply based on evidence, palatability and platforms.

Partnering for Success

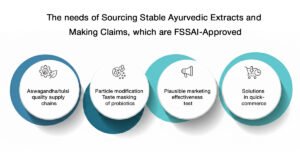

Experts like Foodsure fill the needs of sourcing stable Ayurvedic extracts and making claims, which are FSSAI-approved.

Quiet Value Adds:

- Aswagandha/tulsi quality supply chains

- Particle modification: Taste masking of probiotics

- Plausible marketing effectiveness test

- Solutions in quick-commerce

Founders can see further, and the errors of trial are more quickly eliminated, and the process of functional beverage market fit can be practised faster without herding R&D.

Founder Takeaway

Taste and trends are a smaller factor to be considered because nail preferences introduce flavours that have natural benefits like ashwagandha relaxer or probiotic gut repair in order to appeal to repeat customers in urban areas.

The future of functional drinks in the Indian market is bright for the brands that solve the chaos of everyday life in the real sense and do not follow the trends. Keep it easy: do not hypothesise big, high-speed, and sticky values. You have no execution, you have hype. This hot market shall be under the control of the real-craving founders.

Facing trouble in formulating at the initial stage or claims? Conversation do explain what you mean practically by a functional beverage, to get a clear picture of what we shall put in it, how it will taste, and its extent with ingredients.

DM and slice through the confusion.

and production-ready systems. Structured decisions today prevent expensive fixes tomorrow.

Recommended Blogs

FAQs

Which are functional beverages?

Beverages that are fortified with extra health advantages, such as energy, gut or stress relief, in addition to being hydrating.

What is the reason the market is expanding at such a rapid rate?

Urban Indians are in search of natural solutions to stress, pollution and long working hours with increasing health consciousness.

What are the preferred ingredients among consumers?

Traditional Ayurvedic ingredients such as ashwagandha, tulsi and amla combined with probiotics to make them familiar and effective.

How important is taste?

Both important–unless the medicine tastes good, the beverage is over with; the old-time tastes, such as mango-ginger, will carry the day.

What sugar levels should be?

(<5g/serving) In the use of natural sweeteners, transparency cultivates confidence against sugars under wraps.

What’s the ideal price point?

₹50-100 a bottle with multi-benefits to explain why it is more expensive than standard beverages.

How can founders succeed?

Target taste-benefit fusion, fast-commerce, and particular claims; experiment small through e-commerce and win small.